Lately, a lot has been said about bitcoin on social media. The latest hype is to use bitcoin as a way to store value. Many expect that the inflation will rise because of the increased money supply. But maybe there is a misunderstanding about the inflation. Using bitcoin to store value can be very speculative long term strategy.

When money is distributed it is no necessary reason for inflation. As we learn from the past 10-15 years, it is also important where the money goes. Usually, the market supply and demand regulates the price. A high money supply, does not necessarily mean prices will increase dramatically, if the money does not go the actual economy of goods.

After the crash in 2008, the money distributed to the banks went mostly spent on financial assets, like stocks. This lead to unprecedented growth in the stock market. With some small bumps down the road, from the low in Feb 2009 to the highest level in Feb 2020, the S&P 500 grown about 352%. And if we get Feb 2021 as the last point of reference, the growth was 428%.

Of course, during that period the economy was also doing very well. A lot of the money from the “real” economy was sucked into the financial markets. But this was also due to low interested rates, which allowed high borrowing.

What is the situation today? Since the pandemic started at the beginning of 2020, governments distributed money to the people. The US government is leading the pack with the latest multi-billion package just passed the Senate a few days ago. Is this going to lead to inflation this time? Nevertheless the money was given to the people, one could argue, and not the banks?

First of all the money goes to the banks anyway and the banks will distribute it, so they would cash their fees. But some evidence suggests [1],[2] that the private households, triggered by the social media, put the money in stocks, and something else: bitcoin.

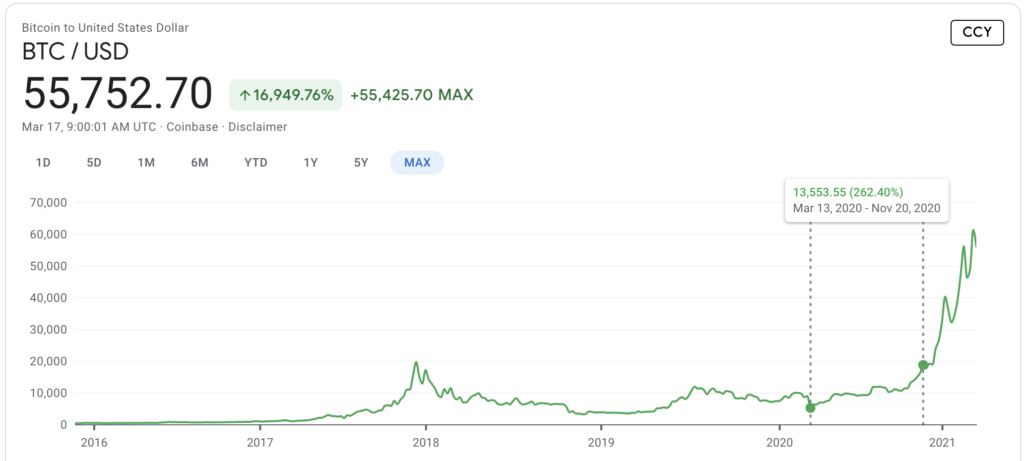

If you look at the price of the bitcoin on March 13, 2020, which was the lowest for the year, shortly before the first stimulus package was signed by President Trump, the price of bitcoin started to climb at a high rate. The stock market often functions as an avalanche. It starts slow but increases rapidly after a point of no return until in crashes.

If our assumption is true, the high price of bitcoin could be seen as inflation. There is a lot of demand for it, hyped by the social media, to people with no knowledge about it and covered by the money supply, sent to the people by the government.

What is the problem with it? Stocks inflation is not necessarily bad. When you buy a stock, you buy a piece of the company, and most people invest long-term today. The challenge is with non-productive assets like Bitcoin. Historically seen we never had a good experience with this type of assets investments. In all of the cases those investments ended up in disaster (Reasons why Warren Buffet hates Bitcoin).

Follow our investments and short term CFD positions on our Mobile App.

References:

[1] https://www.coindesk.com/nearly-40b-in-us-stimulus-checks-may-be-spent-on-bitcoin-and-stocks-mizuho-survey

[2] https://finance.yahoo.com/news/nearly-10-of-the-380-billion-in-stimulus-checks-may-be-used-to-buy-bitcoin-and-stocks-survey-131009531.html