Introduction

In the ever-evolving world of investments, finding a strategy that stands the test of time is akin to discovering a treasure map to financial security. The S&P 500, a benchmark index representing the performance of 500 large companies listed on stock exchanges in the United States, has long been lauded as a cornerstone for savvy investors seeking to build wealth over the long haul. With recent market changes stirring up uncertainty, the resilience and reliability of the S&P 500 come into sharper focus, proving once again its worth as the bedrock of a diversified investment portfolio.

The Allure of the S&P 500

A Historical Beacon of Stability

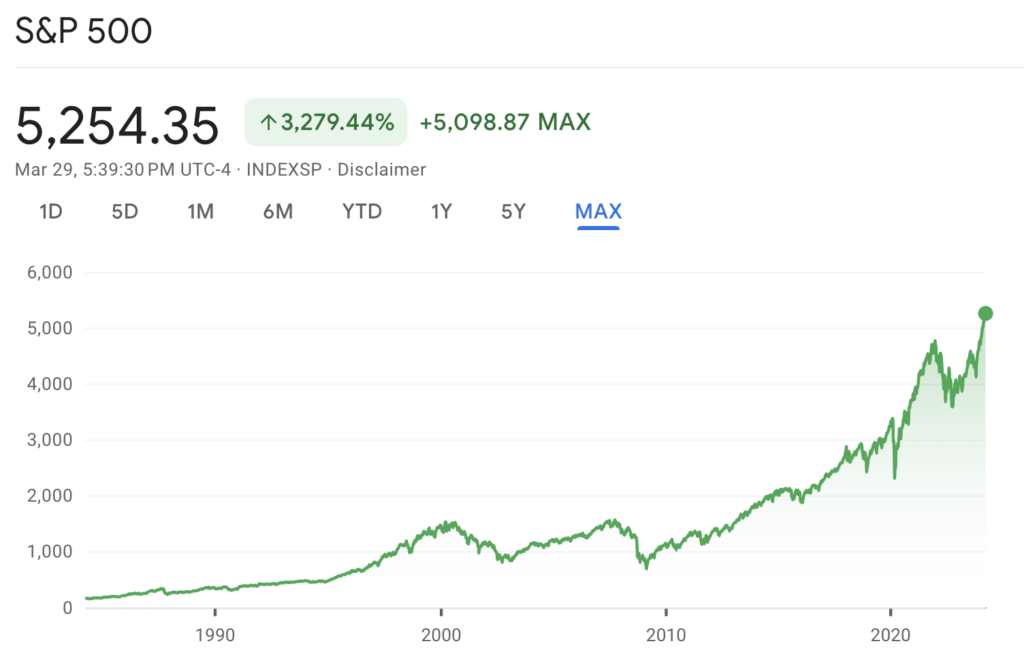

Diving into the historical performance of the S&P 500 reveals a narrative of resilience and steady growth. Over decades, it has weathered economic downturns, market volatility, and geopolitical tensions, consistently offering investors returns that beat inflation and most actively managed funds.

Diversification at Its Finest

One of the S&P 500’s strongest suits is its built-in diversification. Spanning across multiple sectors, from technology giants to consumer staples, it mitigates individual stock risk, making it an ideal choice for investors who seek exposure to the U.S. economy’s broad spectrum without putting all their eggs in one basket.

The Compound Interest Advantage

Long-term investment in the S&P 500 leverages the power of compound interest, where earnings on an investment generate their own earnings. Over time, this snowball effect can turn modest initial investments into substantial nest eggs, underscoring the importance of patience and a long-term outlook in wealth accumulation.

Why it is Always a Good Time to Invest in the S&P 500

Recent market changes have introduced a level of unpredictability, leading many to reconsider their investment strategies. Yet, in these times of uncertainty, the S&P 500 stands out for several reasons:

- Historical Resilience: Time and again, the S&P 500 has rebounded from lows to reach new highs, demonstrating its capacity to recover and grow over the long term.

- Economic Indicators: Despite current fluctuations, fundamental indicators of economic strength in sectors represented in the S&P 500, such as technology and healthcare, suggest sustained growth potential.

- Accessibility: With the advent of index funds and ETFs, investing in the S&P 500 has never been easier, allowing even those with limited investment capital to gain exposure to top-tier U.S. companies.

A Timeless Strategy

While the allure of quick gains in high-risk investments might tempt some, the wisdom of choosing a stable, reliable investment cannot be overstated. The S&P 500’s track record of delivering solid long-term returns, coupled with its ability to navigate through economic uncertainties, reinforces its status as a cornerstone of any well-rounded investment portfolio. As we navigate through the recent market changes, the S&P 500 remains a beacon of resilience, offering a pathway to financial security and prosperity.