We execute a few CFD micro trade trimmings, this time in a reverse way that we would like to share today. Here is why with a few guidance!

How does it work? Basically when the market shows weakness we buy into it and when the market shows the strength we wait for the pullback and buy again.

The first approach buy into weakness, we do this with the indexes we trade like S&P500, and the reason is that historically seen the index tends to recover quickly after loses. Having said that we execute the trades quickly and don’t wait too much, as there is no reason to believe that history always repeats.

On the other hand, when the market shows strength and goes up and up, we usually wait for the pullback before we buy again. There is usually always a good reason for the market to go up, like good news, good financial or economic results, but buying at the tip does not make sense, especially these days where the S&P500 is too high considering all the trade wars and economically contentions.

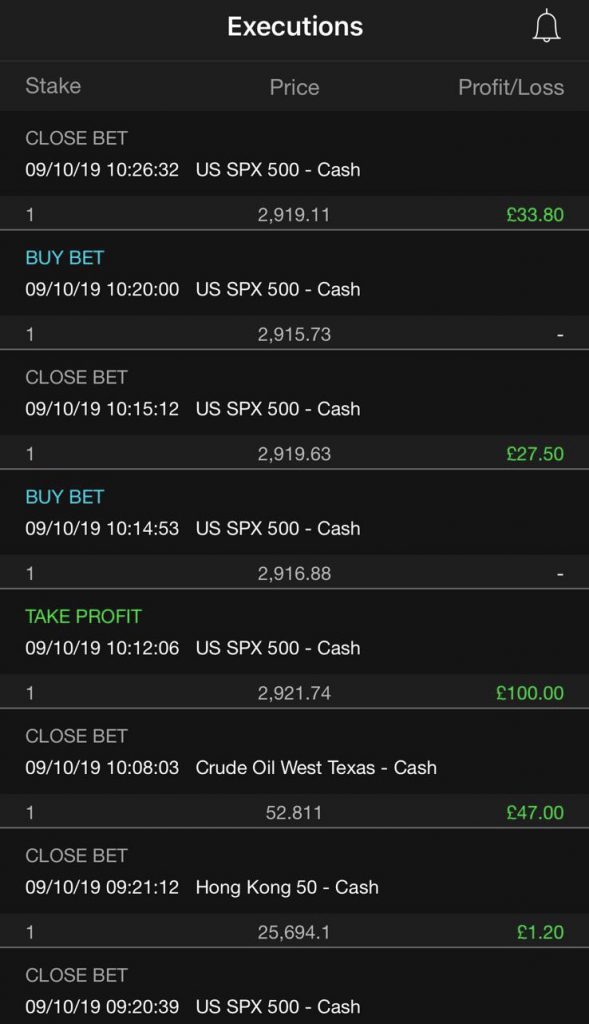

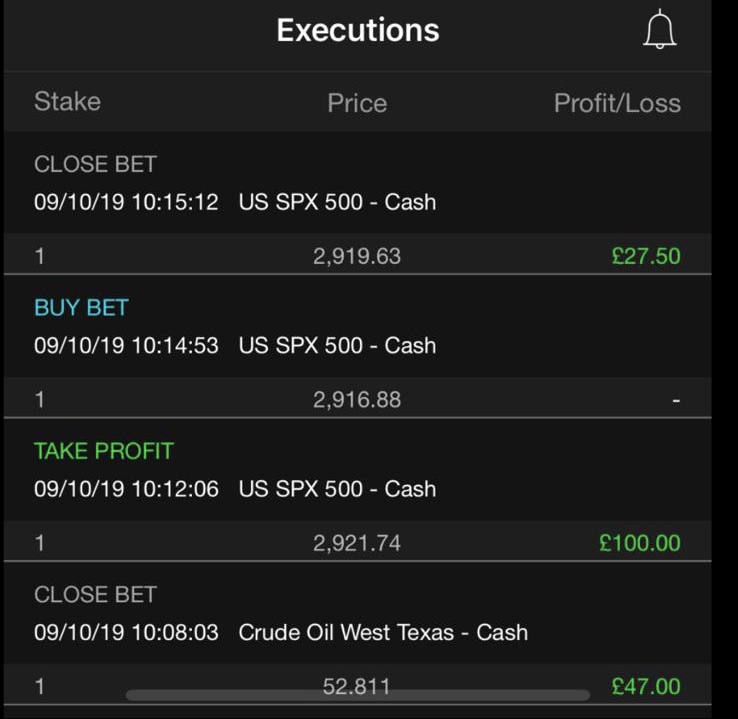

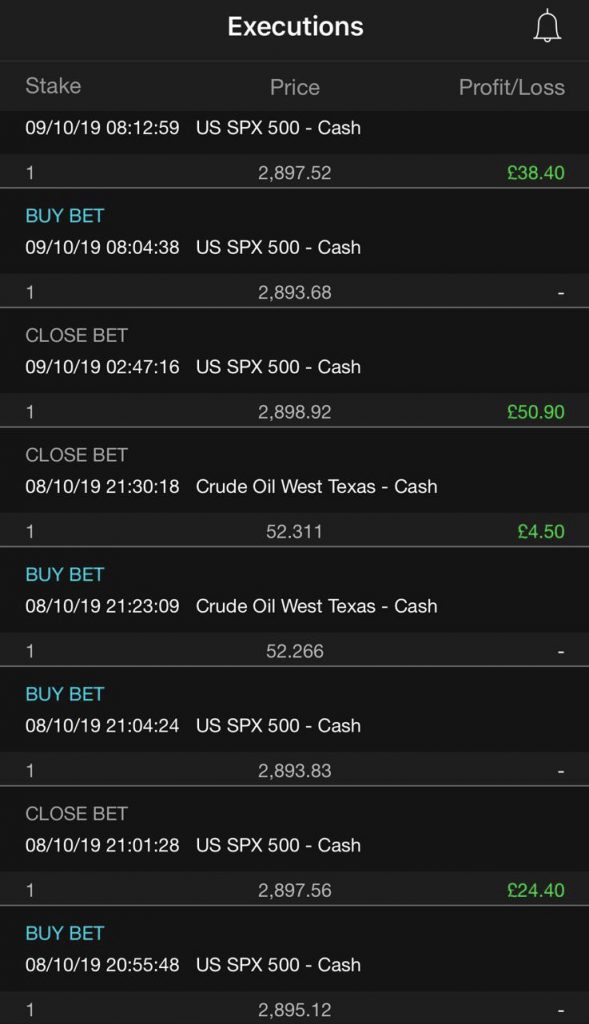

Here a few screenshots examples:

Stay tuned for more examples in the future! Important to mention, we did not send any notifications for most of these trades as some of them had to be executed very quickly, but you will see them in our trade history for October once published in our mobile application, at the end of the month!

DISCLAIMER

One Cent Trading will not be liable for any losses sustained while using the services provided on the One Cent Trading applications. This service is not a solicitation to trade signals, nor is the representation is being made that any account will, or is likely to, achieve profits or losses similar to those discussed on the application, services or trade notifications. The past performance of any trading system or methodology is not necessarily indicative of future results.